Tracking the Trillions: FIRS Launches War on Hidden Funds

The Federal Inland Revenue Service (FIRS) has reaffirmed its commitment to curbing Illicit Financial Flows (IFFs) and enhancing Nigeria’s domestic revenue mobilisation.

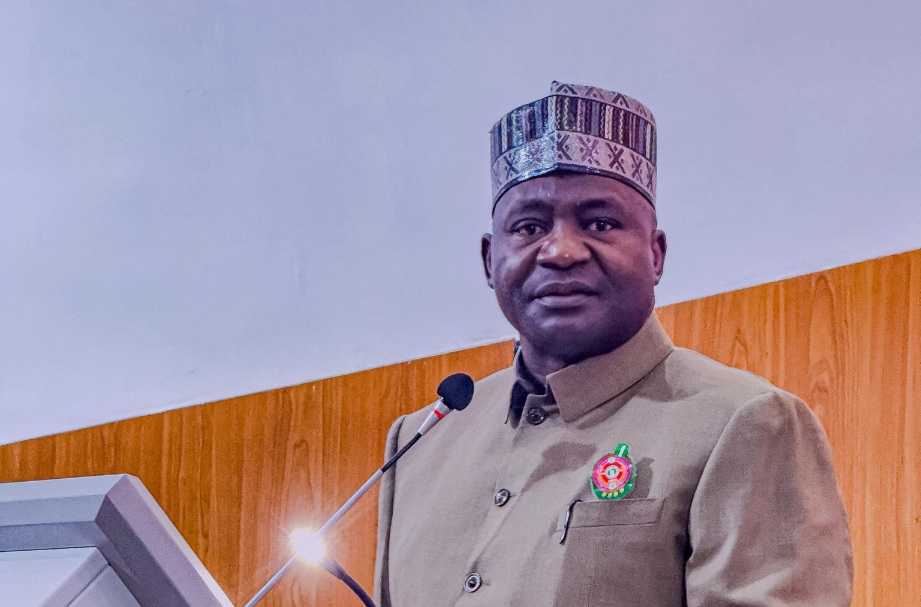

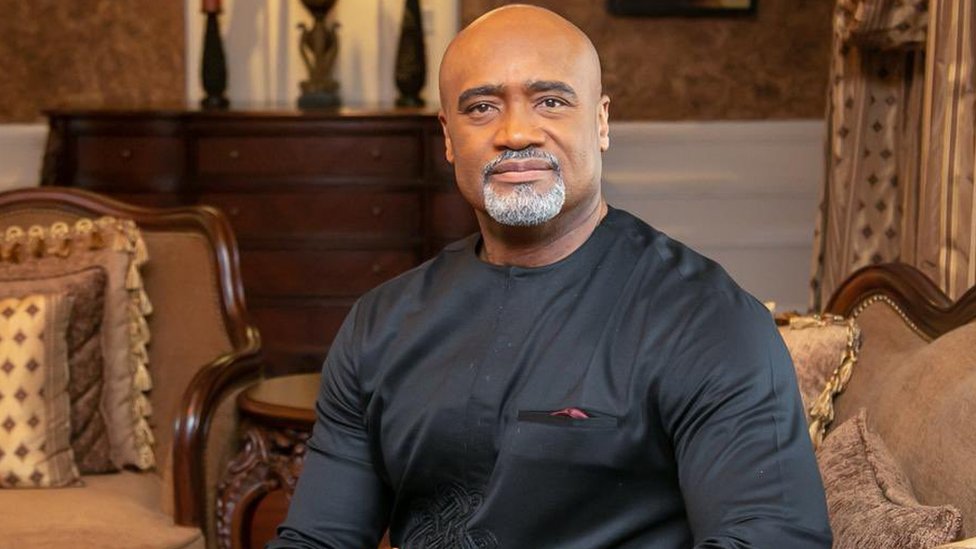

This was disclosed by the Executive Chairman of FIRS, Dr. Zacch Adedeji, in a statement issued by his Special Adviser on Media, Dare Adekanmbi.

Adedeji noted that the agency had previously launched capacity-building programmes aimed at equipping its staff to detect and block IFFs, particularly from multinational corporations.

“To sustain this effort, we approved the establishment of the Proceeds of Crime Management and Illicit Financial Flows Coordinating Directorate (POCM-IFF), which is central to tackling this menace,” he said.

He described tax revenue as a critical component of national development, adding that the Federal Government had already constituted an Inter-Agency Committee to stem IFFs.

The committee includes representatives from the FIRS, Nigerian Financial Intelligence Unit, Independent Corrupt Practices and Other Related Offences Commission (ICPC), Economic and Financial Crimes Commission (EFCC), Nigeria Customs Service, Central Bank of Nigeria (CBN), and the Securities and Exchange Commission (SEC).

As part of ongoing efforts, the FIRS is set to host a two-day national conference on IFFs on 22 and 23 July. Themed “Combating Illicit Financial Flows: Strengthening Nigeria’s Domestic Resource Mobilisation”, the high-level event aims to reinforce national commitment to financial integrity.

Adedeji said the conference will feature stakeholders from across sectors, including policymakers, tax administrators, law enforcement officials, financial experts, and international partners.

A member of the United Nations High-Level Panel on IFFs (FACTI Panel), Irene Ovonji-Odida, will deliver the keynote address. The Minister of State for Finance, Dr Doris Uzoka-Anite, is expected to chair the event.

The conference will highlight FIRS’s initiatives to combat IFFs, including improved compliance mechanisms, enhanced beneficial ownership transparency, and the use of technology to detect and deter tax evasion, trade mispricing, and other illicit activities.