Tinubu Signs Four Tax Reform Bills, Implementation Begins January 2026

President Bola Tinubu has signed into law four tax reform bills recently passed by the National Assembly, marking a significant step in the administration’s fiscal policy agenda.

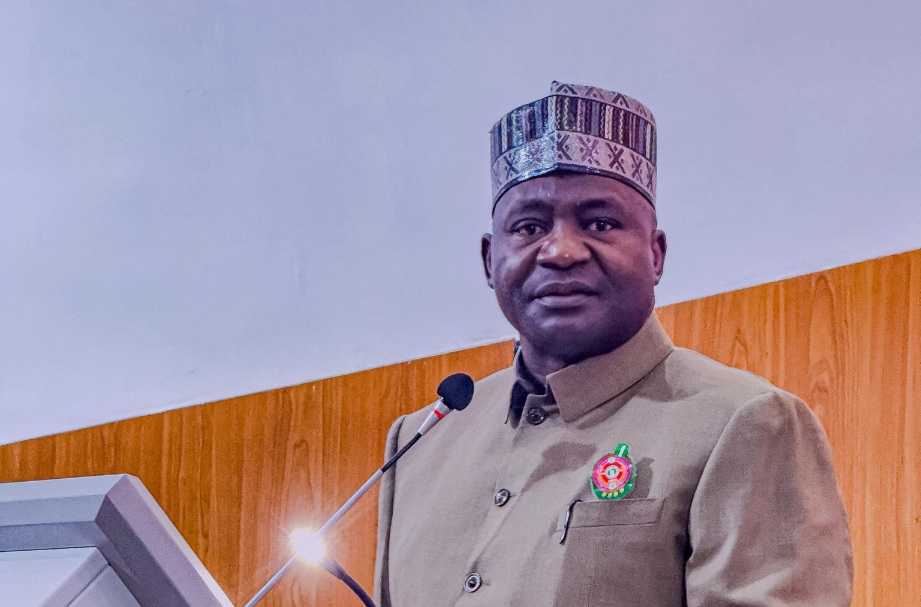

The brief signing ceremony, held on Thursday at the Presidential Villa in Abuja, was attended by members of the National Assembly leadership, some governors, ministers, and presidential aides.

The newly signed legislation includes the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill. These laws were enacted following extensive consultations with various stakeholders and interest groups nationwide.

According to the Presidency, the new tax laws are expected to transform tax administration in Nigeria. They aim to enhance revenue generation, improve the business environment, and attract both domestic and foreign investment.

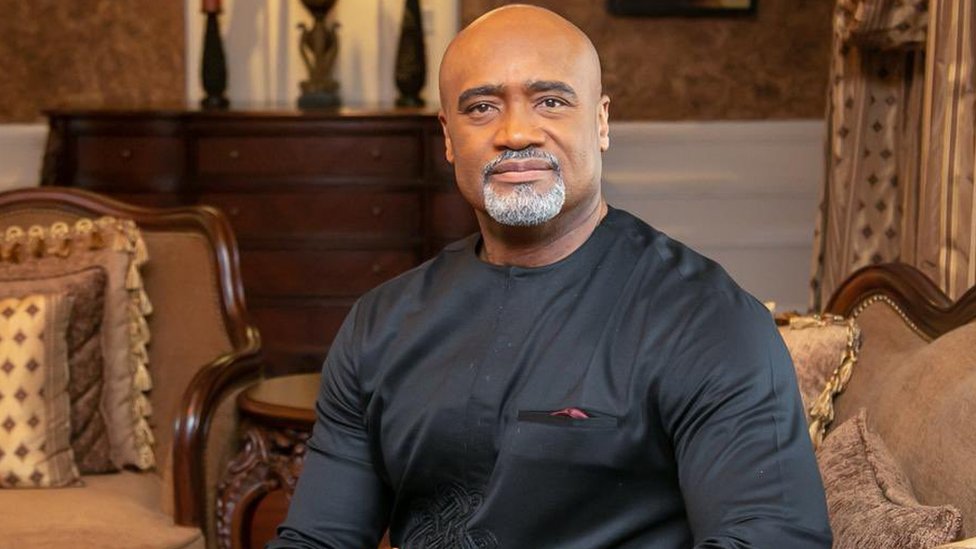

Speaking to journalists after the ceremony, Chairman of the Federal Inland Revenue Service (FIRS), Zacch Adedeji, stated that the new tax regime would take effect from 1 January 2026.

“It takes time for all stakeholders—participants, operators, and regulators—to adapt to a new system,” Adedeji said. “With the support of the National Assembly, the President has assented to the bills. The effective date is 1 January 2026, allowing six full months for public sensitisation and operational planning. This also aligns with the government’s fiscal calendar, as such a major shift cannot be implemented through mere media announcements.”

The tax reforms introduced by the Tinubu administration have generated considerable controversy, drawing criticism from some quarters—including state governors—who expressed concern that certain provisions might impair their ability to meet salary obligations.

However, both the Presidency and the National Assembly have maintained that wide-ranging stakeholder consultations were conducted nationwide and that the concerns raised by governors and other critics have been adequately addressed.