CBN Launches NRBVN to Ease Diaspora Access to Nigerian Banking Services

The Central Bank of Nigeria (CBN), in collaboration with the Nigeria Inter-Bank Settlement System (NIBSS), has launched the Non-Resident Bank Verification Number (NRBVN) platform, enabling Nigerians in the diaspora to obtain a BVN remotely without needing to be physically present in Nigeria.

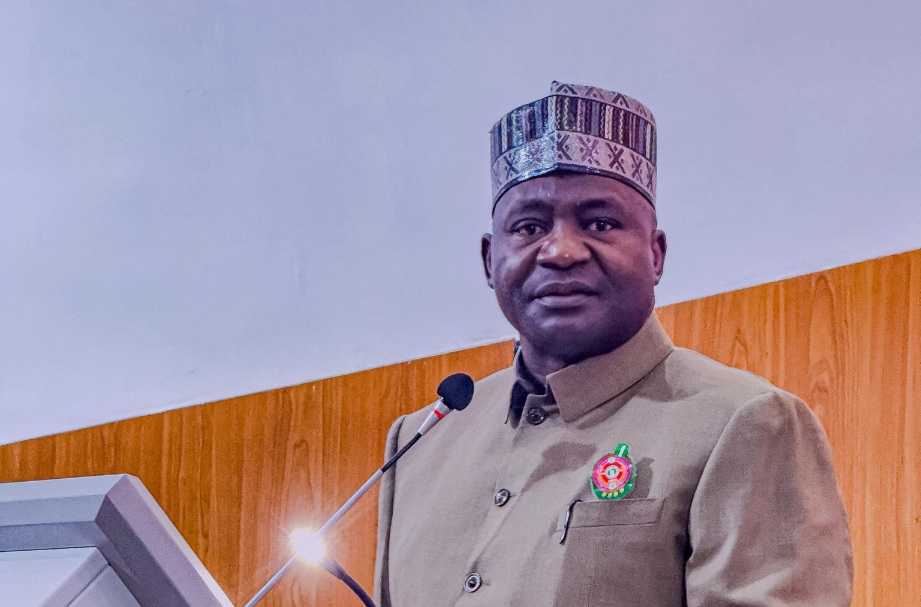

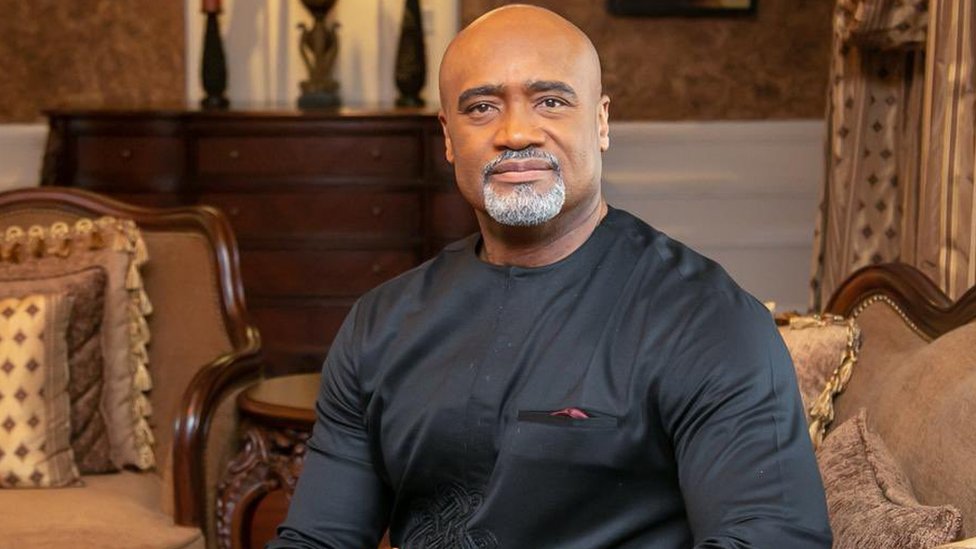

Unveiled on Tuesday in Abuja, the digital initiative aims to support the CBN’s $1 billion monthly diaspora remittance target, projected to reach $12 billion annually. Speaking at the event attended by financial sector stakeholders, including chief executives of commercial banks, CBN Governor Olayemi Cardoso described the platform as a landmark step in deepening financial inclusion and connecting Nigeria with its global citizens.

Cardoso noted that the NRBVN could help lower the high cost of remittances in Sub-Saharan Africa—currently averaging over seven per cent—while encouraging the use of secure and cost-effective formal channels.

“For too long, many Nigerians abroad have struggled to access financial services due to physical verification requirements,” he said. “With NRBVN, secure digital verification and robust Know Your Customer (KYC) processes now make it easier and more affordable for them to do so.”

He described the launch as “the beginning of a broader journey”, with the NRBVN forming part of a wider framework that includes the Non-Resident Ordinary Account (NROA) and the Non-Resident Nigerian Investment Account (NRNIA). These offerings collectively allow diaspora Nigerians to access savings, insurance, pensions, mortgages, and capital market investments.

The platform has been developed in line with global standards, incorporating strong Anti-Money Laundering (AML) and KYC compliance protocols to ensure security, transparency, and integrity. Each NRBVN application undergoes thorough verification to deter illicit financial activity, thereby bolstering international confidence in the Nigerian financial system.

Remittance inflows through formal channels rose from $3.3 billion in 2023 to $4.73 billion in 2024, attributed to recent reforms such as the introduction of the willing buyer, willing seller foreign exchange regime. With NRBVN now operational, the CBN is optimistic about hitting its monthly remittance target.

“This platform is not just about financial access; it’s about national inclusion, innovation, and shared prosperity,” Cardoso added. “We urge all stakeholders to fully comply with the FX Code and other regulatory frameworks to support market integrity and financial system stability.”

He also called on International Money Transfer Operators (IMTOs) to integrate with the NRBVN platform to help build a truly inclusive and efficient financial ecosystem.

Chairperson and Chief Executive of the Nigerians in Diaspora Commission (NiDCOM), Abike Dabiri-Erewa, described the NRBVN as a “game-changer” for diaspora engagement.

The event featured a presentation by NIBSS Managing Director/CEO Premier Oiwoh, and a panel session with key financial industry stakeholders.