Nigeria’s Inflation Falls to 24.48% as New CPI Methodology Takes Effect

Nigeria’s headline inflation rate fell to 24.48% year-on-year in January 2025, marking a sharp decline from the 34.80% recorded in December 2024.

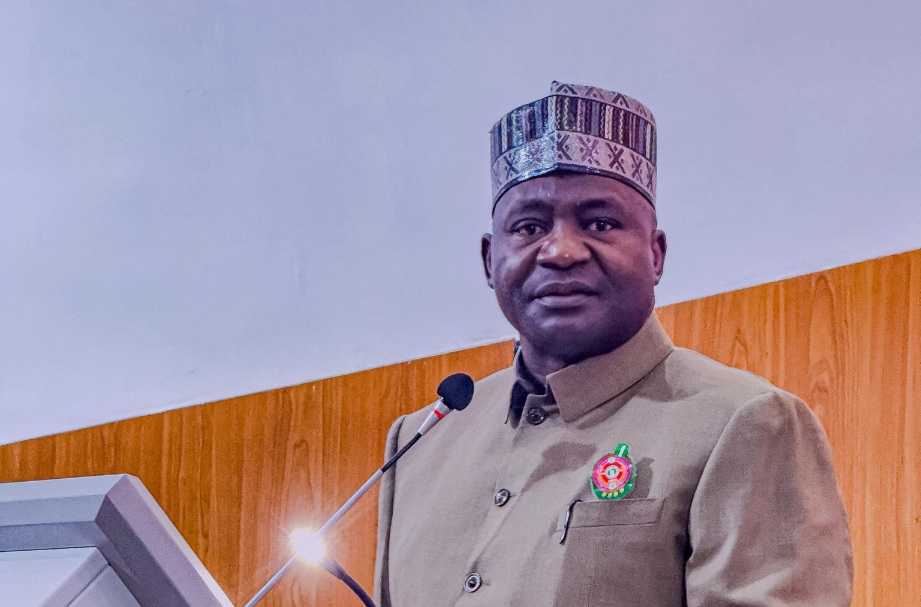

The National Bureau of Statistics (NBS) disclosed this in its latest report, with the Statistician-General of the Federation, Adeyemi Adeniran, making the announcement on Tuesday.

Speaking at a press briefing in Abuja, Adeniran explained that the Consumer Price Index (CPI), which measures the rate of change in the prices of goods and services, dropped to 24.48% in January. He further revealed that urban inflation stood at 26.09%, while rural inflation was recorded at 22.15%.

According to Adeniran, the decline in inflation was partly due to the adoption of a new calculation methodology, replacing the previous template used in December. The rebasing of the CPI was undertaken to align with international standards, ensuring that the inflation data accurately reflects Nigeria’s current economic realities.

CPI rebasing involves updating the reference year and the basket of goods and services used to track inflation. This process provides a more accurate representation of consumer spending patterns and overall economic trends.

The latest CPI figures show that food inflation, based on the rebased index, stood at 26.08% year-on-year in January, a significant drop from 39.84% recorded in December 2024. Similarly, the core inflation index, which excludes volatile items such as agricultural produce and energy, stood at 22.59% year-on-year.

The NBS noted that the updated CPI methodology better reflects current inflationary pressures and consumption habits across the country.

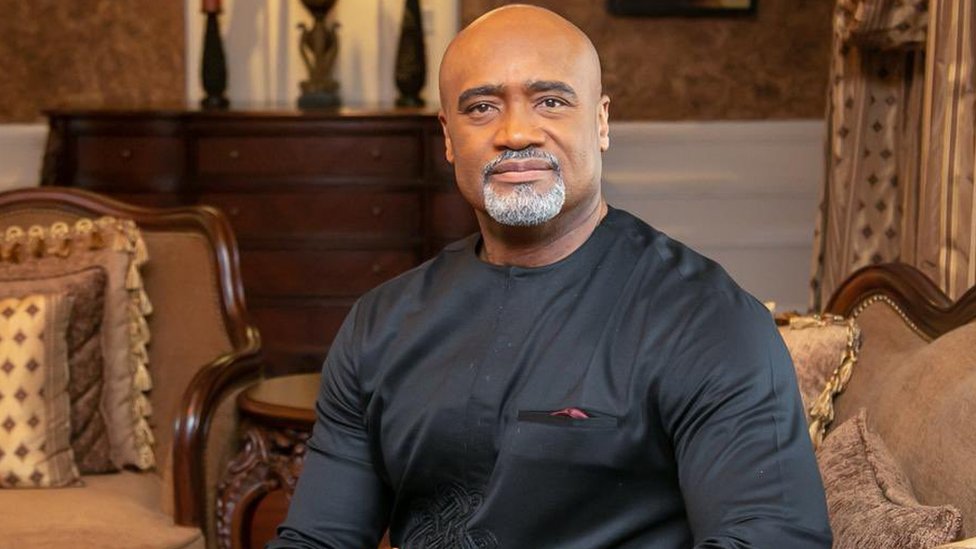

Meanwhile, the Governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, has reaffirmed the apex bank’s commitment to reducing inflation and stabilising the economy.

“Managing disinflation amid persistent economic shocks requires not only sound policies but also close coordination between fiscal and monetary authorities to anchor expectations and sustain investor confidence.

“Our priority remains price stability, transitioning to an inflation-targeting framework, and implementing strategies to restore purchasing power while easing economic hardship,” Cardoso stated during the 2025 Monetary Policy Forum in Abuja.