CBN Attributes Naira Stability to Strong FX Inflows and Tighter Controls

The Central Bank of Nigeria (CBN) has stated that the recent stability of the Naira is driven by increasing foreign exchange (FX) inflows, tighter market controls, and a return to orthodox monetary policy.

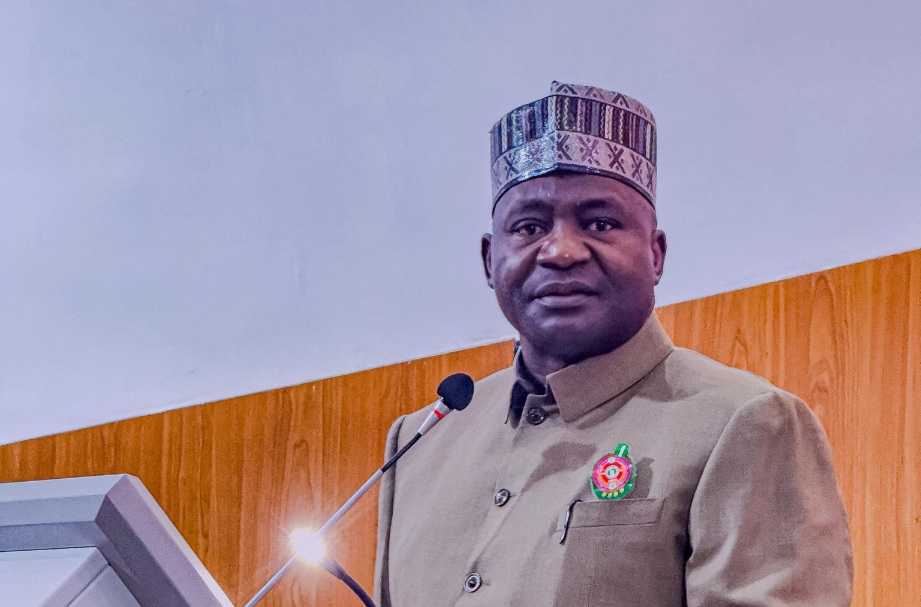

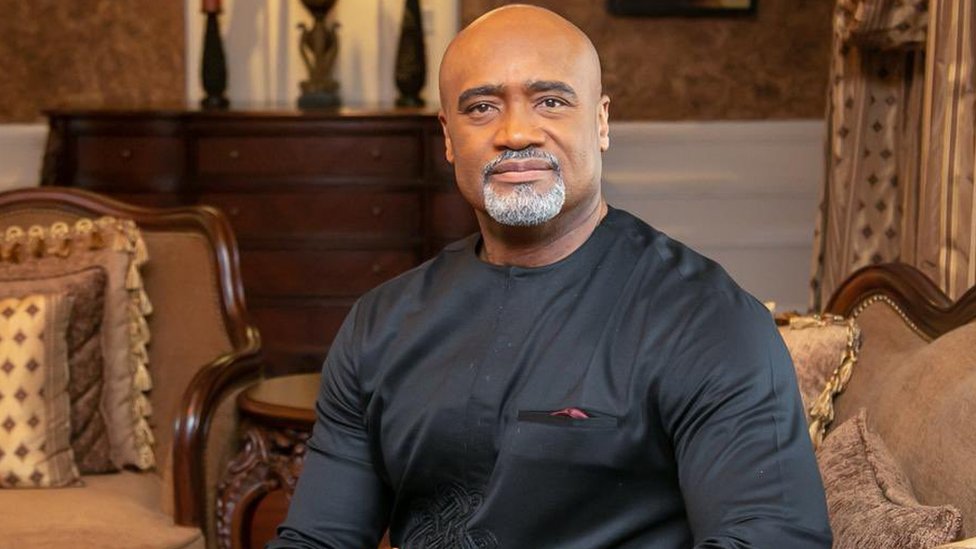

Dr. Victor Eboh, the Director of Monetary Policy at the CBN, made these comments during a Business, Economy and Financial Training for journalists organised by the Premium Times Academy in collaboration with the apex bank in Abuja. According to him, the CBN’s move is aimed at restoring confidence and transparency in the sector.

Dr. Eboh said the Naira had for years been “overvalued,” noting that the current management had allowed the currency to find its true value by removing distortions and preferential access to foreign exchange. He recalled that the exchange rate climbed to about N1,800 to a dollar at the height of market volatility but had since stabilised significantly, closing at about N1,440 to a dollar in the official window.

According to him, stability, not artificially strong rates, remains the administration’s priority.

“Whether you are a big man or not, we all go to the same market now for dollars. There is no longer unauthorised access to FX,” Dr. Eboh said. “Stability is more important than a strong Naira that cannot be sustained.”

He explained that increased transparency and unified access had boosted investor confidence, resulting in higher foreign exchange inflows. He added that the country’s external reserves had risen to over $43bn, representing about nine months of import cover.

“In Ghana, the import cover is about three months. Some West African countries have barely six weeks. Nigeria currently stands at nine months. We have a lot of good news to report,” he said.

The CBN director also said the nation’s balance of payments and current account had remained in surplus, supported by programmes designed to enhance FX liquidity and improve external sector conditions.

On inflation, Dr. Eboh acknowledged that lending rates were still elevated but said monetary tightening was necessary to restore price stability. He warned that uncontrolled inflation would erode purchasing power more severely than short-term constraints on spending.

“You have to choose which one comes first. High inflation is a limitation to growth. It is not about having money in your hand but about what that money can buy,” he said.

Dr. Eboh said the Bank had fully reverted to orthodox monetary policy, focusing on its core mandates while leaving fiscal interventions to the government. “The Central Bank cannot be Minister of Agriculture, Minister of Aviation, and Minister of Transportation at the same time. That is why we have returned to full orthodoxy,” he said.

Dr. Eboh also assured the public that Nigerian banks remain strong and sound despite the ongoing recapitalisation. According to him, the exercise is not due to distress but is intended to position the financial sector to support President Bola Tinubu’s one trillion-dollar economy target.

Dr. Eboh added that the Bank was monitoring monetary aggregates closely to prevent excessive money supply growth from fuelling inflation. He urged journalists to pay particular attention to the behaviour of monetary indicators, especially when reporting on money supply, broad money, and currency in circulation.

The director emphasised that the CBN would sustain measures to ensure exchange rate stability, curb inflationary pressures, and maintain overall financial system soundness.