CBN Keeps Interest Rates Unchanged to Tame Inflation

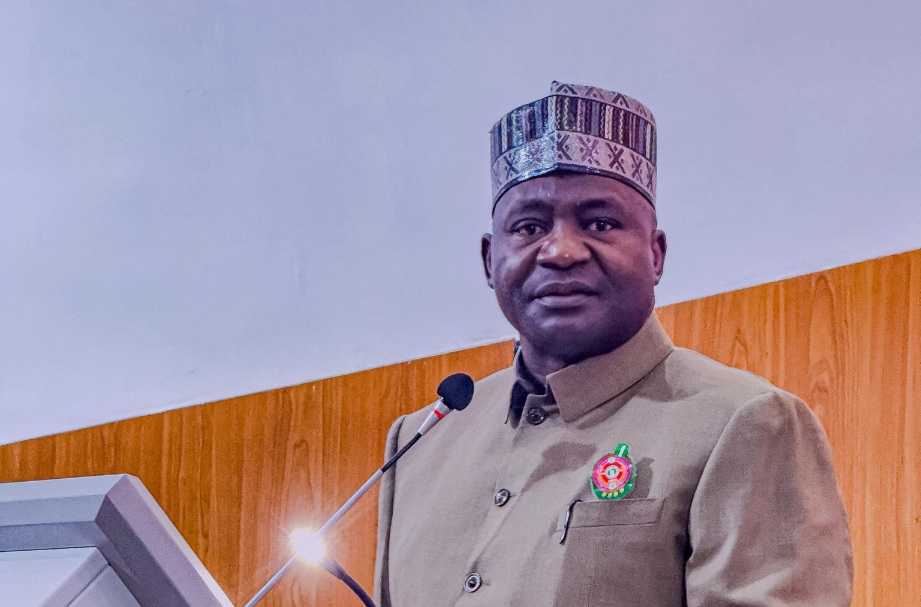

The Central Bank of Nigeria (CBN) has left all key monetary policy parameters unchanged, citing the need to consolidate recent gains in reducing inflation.

Following a two-day meeting, the Monetary Policy Committee (MPC) retained the Monetary Policy Rate (MPR) at 27.5 per cent, with the asymmetric corridor at +500/-100 basis points. The Cash Reserve Ratio remains 50 per cent for deposit banks and 16 per cent for merchant banks, while the Liquidity Ratio stays at 30 per cent.

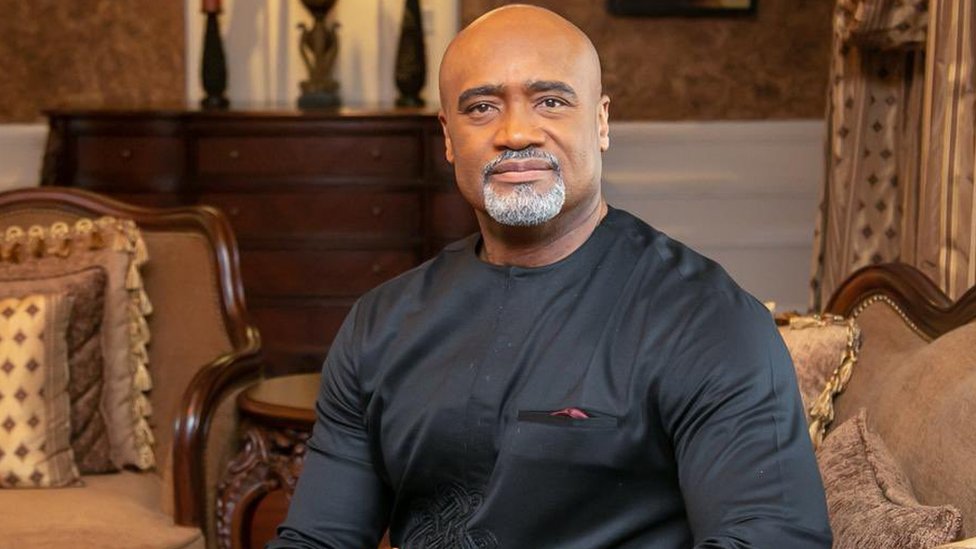

CBN Governor Olayemi Cardoso said the decision aims to contain existing and emerging price pressures and maintain macroeconomic stability.

He noted that Nigeria’s external reserves had risen to $40 billion as of 18 July 2025, equivalent to 9.5 months of import cover.

Despite a decline in annual inflation for the third consecutive month—attributed to falling energy prices and exchange rate stability—Cardoso cautioned against complacency due to persistent month-on-month inflation.

He reaffirmed the bank’s price stability mandate, highlighting stable financial soundness indicators and progress in the banking recapitalisation process, with eight banks already meeting capital requirements ahead of the March 2026 deadline.

Cardoso said international investor interest in Nigeria’s financial sector remained strong, citing a recent major listing on the London Stock Exchange.

The MPC commended government efforts in improving security and food production, urging continued support for farmers and inputs distribution.

CBN staff projections suggest inflation will continue to decline in coming months, supported by tight monetary policy, exchange rate stability, and the harvest season.