UBA Records N804bn Profit in 2024, Declares N3 Final Dividend

United Bank for Africa (UBA) Plc has announced impressive financial results for the year ending 31 December 2024, with substantial improvements across key performance indicators.

According to its audited financial statements filed with the Nigerian Exchange Limited (NGX), the bank recorded a 26.14% increase in profit after tax, rising from N607.7 billion in 2023 to N766.6 billion in 2024. Gross earnings also surged by 53.6%, climbing from N2.08 trillion in 2023 to N3.19 trillion in 2024.

UBA’s total assets saw a remarkable 46.8% increase, expanding from N20.65 trillion in 2023 to N30.4 trillion by the end of 2024. Despite global economic headwinds, the bank reported a 6.1% increase in profit before tax, reaching N803.72 billion compared to N757.68 billion in the previous year.

Shareholders’ funds also experienced significant growth, rising by 68.39% from N2.03 trillion in 2023 to N3.419 trillion in 2024.

As part of its commitment to rewarding shareholders, UBA declared a final dividend of N3.00 per share, bringing the total dividend for the year to N5.00 per share. The final dividend is subject to approval at the upcoming Annual General Meeting (AGM).

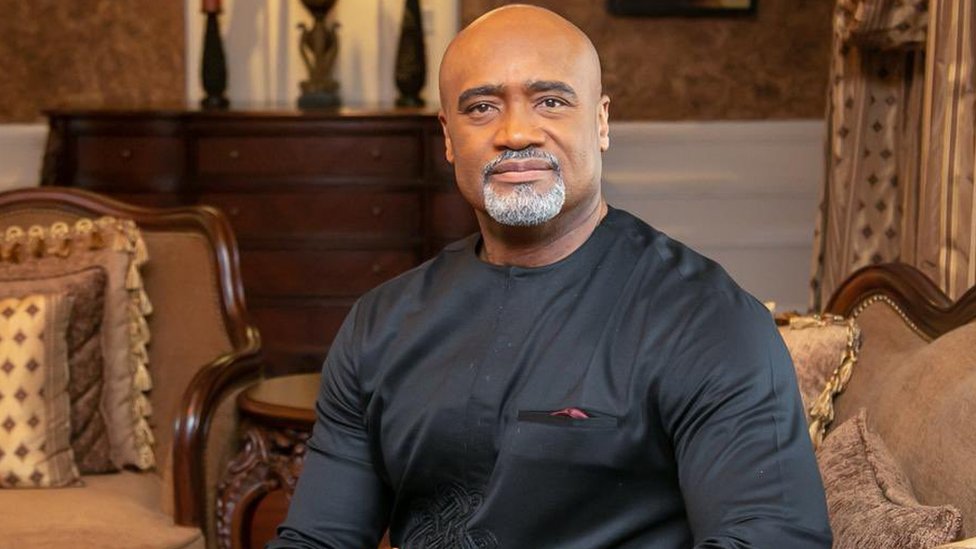

UBA’s Group Managing Director/Chief Executive Officer, Oliver Alawuba, attributed the strong performance to the bank’s continued investment in a diversified global network. “Our focus on earnings growth, asset quality, and market expansion has driven our impressive financial results,” he said.

Despite challenges in the business environment, UBA’s resilience and strategic execution have positioned it as one of Africa’s leading financial institutions, reinforcing its commitment to delivering value to stakeholders.